GOODS AND SERVICES TAX |

| Goods and Services Tax ('GST') is one of the most widely prevalent indirect tax across the globe. In the last 50 years, more than 160 countries have adopted GST. India is preparing itself for ushering GST perceived as a major landmark reform in the Indian Tax System. |

| |

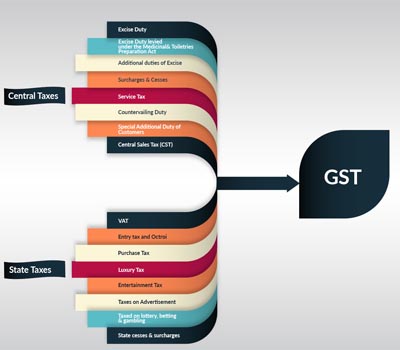

| India is on the fast track to usher in the Goods and Services Tax (GST).GST is intended to remove inefficiencies in the supply chain due to breakage of credit chain and cascading effect of taxes. It will subsume a plethora of indirect taxes presently levied at the central and state level in India. GST envisages a common national market for goods and services and removal of trade barriers. GST will have impact on supply chain, value additions and pricing of final outputs. Thus, businesses will have to examine transaction restructuring, supply chain optimization, business processes, training enterprise personnel, book keeping and making changes in the IT infrastructure so that they are GST ready. |

| |

| GST in India is likely to implemented from 1.7.2017. Introduction of GST would change the way business is done. It would throw host of opportunities and challenges for the business and it becomes imperative for them to gear up themselves for adapting the change. |

| |

| Our services offered are as follows: |

- Registration / Migration under GST

- GST Impact Assessment

- Accounting and Reporting

- Review under existing law- limited review

- Agreement vetting/modification

- Tax optimisation/credit optimization

- Assessment of disputed and refund cases

- Consulting retainership

- Review (periodical) retainership

- Compliance support/outsourcing

- Audit under GST

- Advisory/consultancy on GST

|

| |

| |